IR Magazine Think Tank – East Coast

Exclusively for in-house IRO’s

TD Offices, New York

About the event

WHEN

WHERE

TD Offices, New York

OUR UNIQUE FORMAT

The IR Magazine Think Tank – East Coast took place on Thursday, May 23 in New York and was an invitation-only event exclusively for senior IR officers. Our thinks tanks were free to attend and our unique format enables participants to network extensively, discuss, debate and dissect topical issues affecting today’s IROs.

What makes our format so unique?

Our think tanks are far removed from the traditional conference set-up as the event consisted of a series of panel sessions followed by roundtable discussions on select IR issues. These interactive sessions were an opportunity to share experiences with and learn from other top-rated IROs. All table discussions were confidential and none of the participants’ comments are attributed. This allowed attendees to talk freely and have frank, open discussions.

How do our roundtable discussions work?

Industry experts, top-rated IROs and members of the investment community set the agenda on a panel discussion by sharing their thoughts on session topics.

Small round tables of IROs discuss these issues face to face.

Each table gives feedback from its discussion and shares ideas with the group as a whole.

NIRI IRC® CREDENTIAL

Holders of the NIRI IRC® credential can earn up to 4 professional development unit (PDUs) per day. IRC-credentialed speakers may also earn PDUs. For more information about the Investor Relations Charter (IRC)®, please visit www.niri.org/certification.

Agenda: 2024

The 2025 agenda will be announced soon. In the meantime, explore the 2024 agenda to get a sense of what’s in store.

Times are shown in ET (Eastern Time).

08:30am

Registration, refreshments and networking

09:30am

IR in uncertain economic and political times

IR professionals have many milestones to work towards throughout their calendar An estimated 49% of the global population will be heading to the voting booths in 2024, international conflict and geopolitical tensions are impacting markets and businesses, and the global economy remains uncertain.

These global events impact businesses, their operations, and domestic and international investors.

Although IR can’t alter the external environment, in our opening session we explore how teams can respond to investor concerns around country, sector, or company risks and how to adapt to changes in investment flows.

Moderator: Steven Wade, head of content, IR Magazine

Amritha Kasturirangan, vice president, portfolio manager and research analyst, Franklin

Templeton

Aimee Remey, vice president US, investor relations, Entain

10:00am

Artificial intelligence: Real-life use cases for IR

Go beyond the theoretical in this IR-specific and enlightening session around using artificial intelligence as part of your investor relations program.

As corporations adopt more sophisticated, enterprise-level AI tools, and confidence grows around their ability to enhance efficiency in activities, we look at some real-life examples of how IR teams utilize this powerful technology to add value to their IR program.

Moderator: Steven Wade, head of content, IR Magazine

Arin Grossbard, senior director of strategy, Notified

Matt Humphries, vice president, investor relations & global corporate communications, Blackline

10:30am

Roundtables: How IR can adapt to emerging threats and opportunities

11:15am

Coffee break

11:45am

Earnings calls: Preparing management and analysts

Earnings calls are a time when IR is thrust into the spotlight, and any mistakes are magnified in the eyes of management and the investment community. A great deal of attention to detail and forward planning is required to prepare management teams and manage expectations with analysts.

However, with economic uncertainty and wider spreads in consensus, it can become more difficult to predict how analyst expectations, questions and reactions to your results. This in turn makes it increasingly difficult to prepare management teams for the earnings call.

This session will examine some nuances to expect in the next earnings season, and how best to manage consensus and prepare management teams in the lead up to your announcement.

Moderator: Lauren McDonald, conference producer, IR Magazine

Ally DeVoe, senior manager, investor relations, Boston Scientific Corporation

Mark Loehr, CEO, OpenExchange

Keri Mattox, senior vice president, chief communications and administration officer, Zimmer Biomet

Giuseppe Montefinese, manager, contributor relations – U.S., Visible Alpha, now a part of S&P Global

12:25pm

Maximizing your time with management: New approaches to roadshow planning and corporate access

Efficient targeting is an essential part of all successful IR programmes and crucial to Investor engagement has significantly changed over recent years due to trends related to hybrid working, business travel and event attendance. It is now more challenging to fill roadshow schedules and enhance management’s time on the road.

This session discusses creative ways IR teams can adapt to a changing corporate access environment and facilitate quality in-person investor engagement.

Moderator: Steven Wade, head of content, IR Magazine

Meg Dodge, vice president, investor relations and corporate communications, Rocket Pharma

Pravesh Khandelwal, vice president, head of investor relations, Embecta

Jana Zinn, head of corporate access, TD Cowen, a division of TD Securities

12:55pm

Roundtables: Improving investor engagement

13:30pm

Lunch

14:30pm

Scope 3, or not scope 3? What is happening with ESG reporting requirements

The global ESG regulatory landscape is constantly evolving, and regulations are becoming increasingly more complex and varied in their requirements.

The SEC Climate Disclosure Rule and Californian Climate Corporate Data Accountability Act will impact most US listed companies, and many North American corporations will be scoped into the European Commission’s Corporate Sustainability Reporting Directive. This means that companies need to understand the data collection and disclosure requirements they are subject to, carry out a gap analysis and revamp their ESG story.

In this session, we analyze the global climate disclosure landscape, discuss the timeline and intricacies of the rules, approach to materiality, scope 3 reporting and assurance demands and together we share examples of how companies can adapt to evolving expectations of companies and their ESG disclosures.

Moderator: Lauren McDonald, conference producer, IR Magazine

Prabh Banga, vice president of sustainability, Aecon Group

Shira Goldmann, senior manager, ESG, Verizon

15:00pm

Q&A with investors and analysts: Get your questions answered!

In our final session, we ask the buyside to share their perspectives on the investment outlook, priorities for management teams and how investor relations activities can improve.

In a much-loved format, the audience are invited to ask questions directly to investment analysts and portfolio managers to get constructive feedback and insight from one of IR’s key stakeholders.

Moderator: Steven Wade, Head of content, IR Magazine

Rupal Bhansali, CEO, CIO and portfolio manager of international & global equity strategies, Double Duty Money Management

Ellen Carr, principal and high yield bond portfolio manager, Barksdale Investment Management

Thaddeus Pollock, executive vice president, head of value equity, head of sustainable investing, Mutual of America Capital Management

16:00pm

Drinks reception and networking

16:45pm

End of event

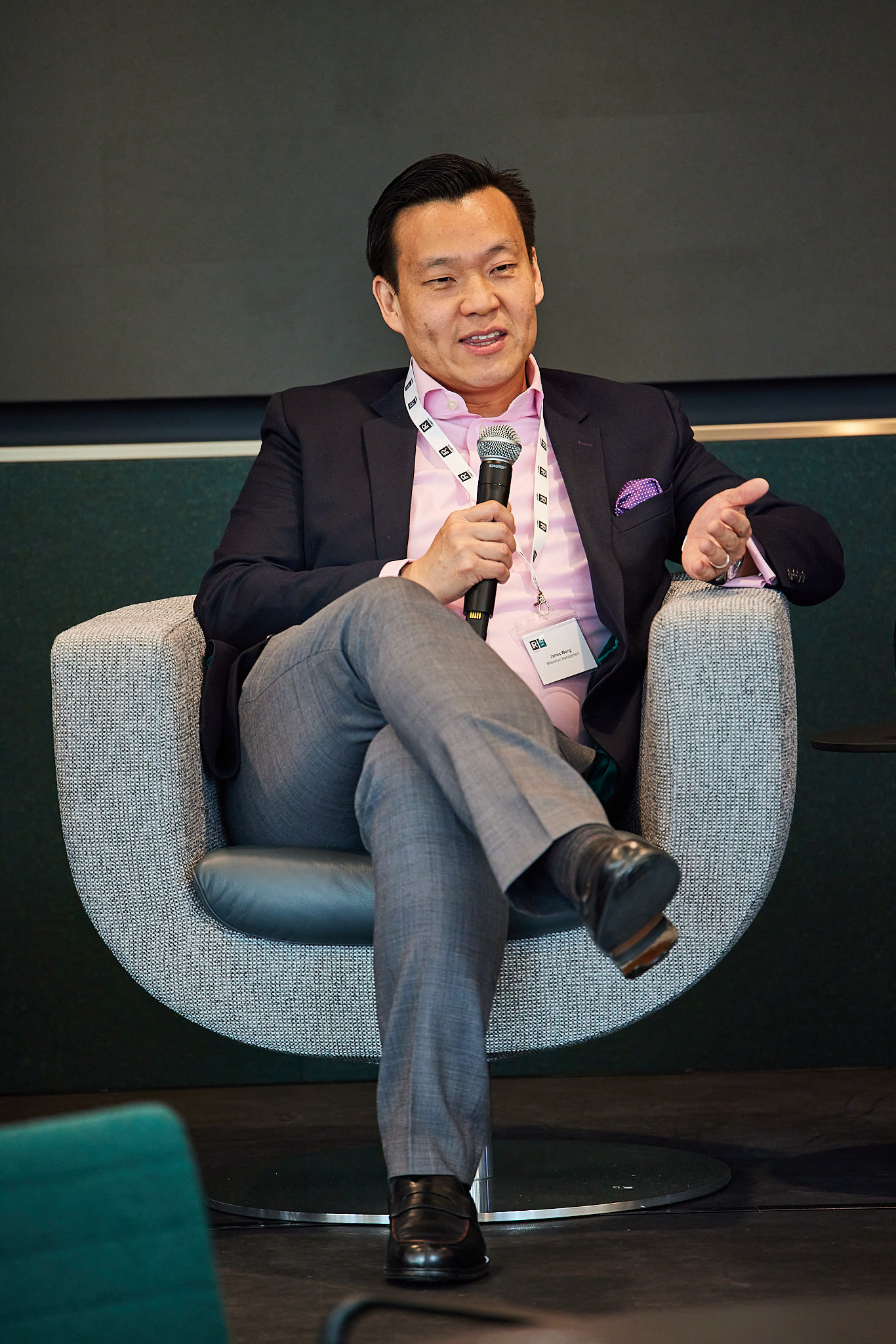

Event speakers: 2024

What our attendees say

Attendees

Our attendees are leading IR practitioners with an established track record and strategic IR role within their company.

Below is a sample list of our past attendees:

| JOB TITLE | COMPANY |

|---|---|

| Director, IR | Vuzix |

| Director, IR | General Electric |

| Director, IR | Flushing Financial |

| Director, IR | ORIX Corporation |

| Director, IR | Jushi Holdings |

| Senior director, head of IR | Lantheus Holdings |

| Senior director, IR | Becton Dickinson |

| Senior director, IR & corporate communications | TCR2 Therapeutics |

| Senior vice president, director of IR | Chubb |

| Senior vice president, head of IR & treasury | Nielsen |

| Senior vice president, IR | SmartRent |

| Senior vice president, IR | CACI |

| JOB TITLE | COMPANY |

|---|---|

| Senior vice president, IR | Comcast |

| Senior vice president, IR | Coty |

| Senior vice president, IR | Estee Lauder |

| Senior vice president, IR | CVS Health |

| Vice president | Hannon Armstrong |

| Vice president, head of IR | Starbucks |

| Vice president, IR | Ingersoll Rand |

| Vice president, IR | Quotient Technology |

| Vice president, IR | Roku |

| Vice president, IR | Campbell |

| Vice president, IR | WW International |

| Vice president, IR | Ciena |

Thinking of becoming an event partner?

Our events provide a unique opportunity to get in front of some of the most influential people in the IR community. As a partner, you will gain an extensive amount of exposure through a wide range of print and digital marketing materials, both pre and post event, as well as on the day itself. Additionally, you can use the event to align yourself with IR excellence and network with key decision makers from across the region – the ones pushing the profession forward through innovation.

Key insights into the latest ir trends and best practices

How to boost your IR salary and measure your IR success: The Ticker 146

In the latest episode of The Ticker podcast, we talk everything careers

Best Practice Report: Rethinking retail investors now available

Pre-pandemic, few IR professionals focused on retail investors; the rise of commission-free trading apps coupled with lockdown time and extra cash changed that. After millions of retail investors joined the market in recent years, we hear from leading IROs about how to successfully boost your retail base, how to effectively communicate with this group and […]

The eight trends that will define investor relations in 2024

Leading IROs pick themes that will define their profession over the next 12 months

Register your interest

Gallery – 2024

Gallery – 2023

Contact us

Upcoming events

-

Webinar – Effective earnings preparation amid macro volatility

In partnership with WHEN 8.00 am PT / 11.00 am ET / 4.00 pm BST / 5.00 pm CET DURATION 45 minutes About the event Amid constant tariff news, geopolitical upheaval and other developments stemming from the new US administration, IR teams have their work cut out as they prepare…

-

-