Deep Dives

-

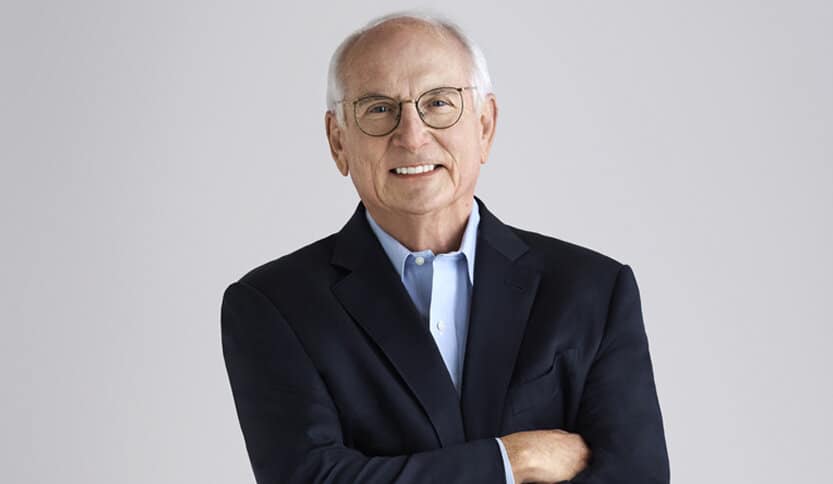

‘We’re thinking about what AI is going to destroy as much as what it’s going to create’: Jonathan Knowles of Compound Equity Group

Compound Equity Group (CEG) was founded in 2024 and seeks high-conviction, long-term ideas in global equities. The founder and portfolio manager in charge, Jonathan Knowles, spent more than 30 years managing money at Capital Group. At his time of retirement in December 2024, he was in charge of some $50 bn in assets and was the chief investment officer of the firm’s $70 bn small-cap fund – the largest such fund in the world. CEG has recently raised $500 mn in capital and is deploying a very long-term, highly concentrated approach: to have 20 to 25 investments with some positions…

-

The CFO: ‘You need to have a stomach of iron during times of volatility,’ says Block’s Amrita Ahuja

Many IROs hope that their time in the profession might set them up well for a C-suite position well one day. But for Amrita Ahuja, CFO and COO for payments company Block, the transition happened directly during her time as head of IR for interactive entertainment firm Activision Blizzard, where she was called upon to become finance chief of its video-game publishing wing Blizzard Entertainment in 2018. Fast forward a few years and she now holds the dual posts of CFO and – for the past two years – COO at Block, the financial technology company founded by Jack Dorsey,…

-

Taking management on tour: What’s the sweet spot for investor meeting attendance?

‘We’re spending more time with investors without our management team,’ Naji Baydoun, director of IR at Innergex, told IR Impact editor Laurie Havelock in the Global Roadshow Report 2025. ‘Maybe at the beginning of the [2024] we were spending 10 percent of our investor engagements without management and now we’re up to about 25 percent with just the IR team,’ explained Baydoun. ‘That’s because we’ve built relationships and trust with those investors, so I’m happy about that.’ According to IR Impact’s 15th annual research report into the who, where, how and why of corporate roadshow activity, there has been a…

-

How to talk tariffs: IR in the new era of uncertainty

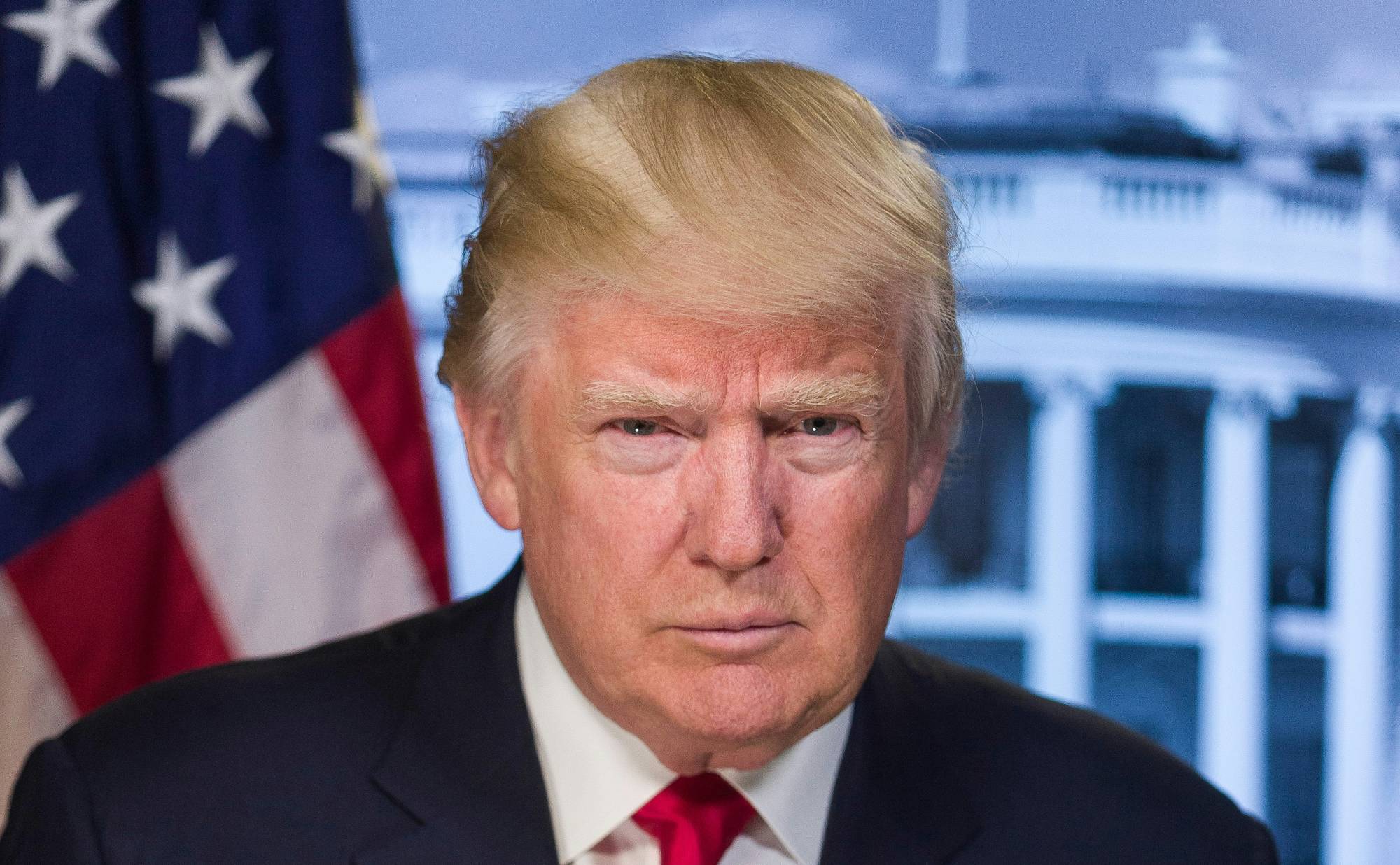

The US economy is in ‘a period of transition,’ US President Donald Trump told Fox News on Sunday. By close of trading on Monday, the US S&P 500 had dropped almost 3 percent, with tech stocks taking a particularly heavy hit. Weeks of back and forth as Trump threatened tariffs, paused tariffs, reintroduced tariffs – and saw retaliatory levies by affected markets – finally came to a head.

-

‘I under-appreciated the work that went into IR’: What it’s really like to move from the sell side to investor relations

When asked for an example of a time she really leaned into her skills honed on the sell side, Bonita To, director of investor relations at First Quantum Minerals, points to a unique situation: the shutting down of one of the firm’s mines by the Panamanian government in November 2023. ‘The balance sheet became quite distressed and it was very apparent that we would need to take some action in terms of addressing our liquidity constraints – including going to the capital markets,’ she recalls.

-

The CFO: The best IROs bring in ideas from all over, says Ciena’s finance chief

Gregg Lampf, head of IR at Ciena, is a familiar face at IR Impact events. He’s also a big advocate for AI for investor relations – a topic he talks about, writes about and puts to work in his day job.

-

‘What we don’t need is more masculine energy’: Where ESG fits in the corporate scandal warning system

What links Wells Fargo, the largest retail bank in the US with Boeing or failed blood-analysis startup Theranos? They all offer up examples of corporate scandal that feature in Guido Palazzo’s book The Dark Pattern: The hidden dynamics of corporate scandal, co-authored with Ulrich Hoffrage. In it, Palazzo, a professor of business ethics and TEDx Talk speaker, and Hoffrage, a professor of decision theory, seek to uncover what lands huge multinational firms with multi-million-dollar fines for fraud, their senior executives at best fired or at worst jailed.

-

Rather be canoeing the Mekong River than riding the corporate commute? Perhaps it’s time for an IR sabbatical

This time last year Andrea James was spending time with her young family, going to yoga twice a week and generally taking the slow approach to life. Today, she is CFO at Nasdaq-listed Oncocyte, a molecular diagnostics technology company. James explains that when she first decided to take a career break – at the time she was chief communications officer and IR head at alternative defense firm Axon – she didn’t know what she wanted to do next. ‘I needed to get out of the day-to-day of being at a rapid-growth company, in a highly visible role, to find that…

-

‘I’ve seen the good and the bad from the sell side – it’s framed how I approach IR’: Inside IR at Alamos Gold

What does it take to become an award-winning IRO? Scott Parsons, a former sell-side analyst who joined the IR team at Alamos Gold in 2013, working his way up to lead the program, knows that a lot of it is hard work. But successful IR is also about honing your organizational skills, your people skills and your ability to package up the company story in a way that makes it work for investors and analysts. Here, we dive into the IR program at Alamos Gold to hear about everything from the sell-side to IR learning curve, the way ESG conversations…

-

The CFO: Heads of IR should understand their company better than management, says Alamos Gold finance chief

To mark the first of the year’s CFO interviews, we headed to Toronto to talk IR with Greg Fisher, finance chief at Alamos Gold – a company that has been repeatedly recognized for its efforts in investor relations

-

Personality and pandemics: What we learned from a year of talking IR with CFOs

As the year draws to a close, we look back on 12 months of The CFO column. What started with Kurt Barton of Tractor Supply Company expanded to conversations about all things IR with finance chiefs from Brazil’s NuBank to Hong Kong’s Sa Sa International, Canada’s Cineplex to Campbell’s Soup Company in the US – and many more. We discussed the benefits that good IR can deliver, about what they look for in their heads of IR, about what works in corporate access and what they liked most – and least – about their involvement in the IR program.

-

The CFO: ‘Our ultimate mission is the protection of lives’, says finance chief of Japan’s Weathernews Inc

Masanori Yoshitake talks weather, climate and society, ramping up IR and taking investors from a financial return to an emotional one

-

Why Brian Thompson’s killing has prompted companies to think about executive safety and corporate purpose

‘Executive security used to be something of a hard sell,’ says Iylia Lavatelli, a former close-protection security provider, now working at operational resilience firm Restrata, talking about budget as well as executive willingness playing their parts in what any security manager can achieve. That, of course, changed with the shooting of Brian Thompson, UnitedHealthcare CEO, in New York last week. The news today is of companies scrambling to organize their security and senior profiles being removed from corporate websites – health insurance firms in particular

-

The CFO: Ultimate Products’ finance chief on what he’ll look for when it’s time to hire an IRO

What did you use to keen an eye on that lockdown weight gain? In many markets, the chances are it was a trusted pair of Salter bathroom scales. That’s what Chris Dent has in his home – and what sits in the homes of around 70 percent of Brits. They are just one of the 3,000 or so products designed, manufactured and distributed b London-listed Ultimate Products. In the latest installment to The CFO series, Dent talks about how an education in history helps him tell a good company story, the benefits of being able to bring out company experts…

-

The CFO: Gord Nelson of Cineplex on how strategy, growth and transparency can get you into the C-suite

Speaking to Gord Nelson, CFO of Cineplex, you get a real feel for why he’s so good at what he does. For him, a successful finance chief needs much more than technical skills – they need those personal qualities that really connect with investors and bring the company story to life. As we chat, Ellis Jacob, the firm’s CEO, pops in to ask Nelson a question. This is indicative of the close-knit relationship enjoyed by the company’s senior management has – perhaps because they’ve been through ups and downs, listings and market growth, near-buyouts and pandemics together

-

The CFO: ‘You invariably learn something about your business’ from investors and analysts, says Hostelworld finance chief

Caroline Sherry talks about entering the travel sector just months before Covid-19, the small-team approach and why everyone should visit Dublin

-

How to rebuild investor trust after an earnings miss

Four practical steps for IR teams to restore credibility and reinforce the long-term value of the company’s story

-

The worst day of my IR life: Dealing with the fallout from stock option backdating

Ciena’s head of IR Gregg Lampf discusses the crisis that helped form his IR career

-

Cyber-security exclusive: Inside the IR response to a major hack

Issue increasingly on the radar of boards – and regulators

-

‘Being an IRO gave me a deep appreciation of how important it is to be a steward of value’ – Wave CFO on the transition from IR

From building trust externally to developing internal confidence, Michaella Gallina talks transferrable IR skills

-

How to handle profit warnings

IR veterans share experiences and best practices for communicating around an earnings miss

-

The biggest mistakes IR teams can make in a crisis

IROs, investors and analysts offer their thoughts on navigating difficult situations

-

Making waves: Eco Wave Power CEO on building trust through the IPO

Founder of Nasdaq First North-listed firm on weathering the fossil fuel rally and why stock price matters less in such a new sector

-

When the SEC calls: Recommendations for IROs caught up in an enforcement action over reporting or accounting issues

Q&A with David Oliwenstein, a partner at law firm Pillsbury Winthrop Shaw Pittman and former staffer at the SEC’s division of enforcement

-

The CFO: The challenges are where you make a difference, says Sa Sa International’s finance chief

Danny Ho talks working on different sides of the corporate fence and taking himself out of the ‘risk-averse’ mindset of a chartered accountant

-

Investor newsletters remain a useful tool, argue IR teams

Newsletters are the communications channel that receives most direct engagement, says Patrick Kiss of Deutsche EuroShop

-

Making the most of data during investor events

It’s becoming easier to connect events intelligence with other aspects of the IR program, say industry partners

-

‘Investors can still be taken by surprise’: Morningstar’s Lindsey Stewart talks ESG

Stewardship researcher on the questions that have come out of the ‘big think’ on ESG and bridging the gap between values and investment

-

‘Sexy is not the right adjective for our industry’: Inside waste disposal firm Clean Harbors’ award-winning investor day

Company awarded best investor event (small to mid-cap) trophy at the IR Magazine Awards – US 2024