About the event

WHEN

WHERE

Leonardo Royal Hotel London City

Building an AI-Powered IR strategy

With an increasing number of investors, governance and corporate communications teams adopting machine-learning and generative AI to support their day-to-day decision-making, it is critical for IR teams to follow suit. However, at this nascent stage, there were a lot of questions about the ethical use of AI, accuracy, privacy concerns and more.

The AI for IR forum on March 7 in London was designed to provide IR teams at publicly listed companies with a blueprint for the responsible use of AI to supercharge their IR program.

Featuring AI veterans from the buy side, experts from tech companies, and issuers who had successfully implemented AI, the forum provided actionable checklists and best practice booklets on how to successfully implement an AI-powered IR strategy in 2024.

Agenda: 2024

The 2025 agenda will be announced soon. In the meantime, explore the 2024 agenda to get a sense of what’s in store.

Times are shown in GMT (Greenwich Mean Time).

08:30am

Registration, breakfast and morning networking

08:55am

Welcome to IR Magazine Forum – AI for IR

09:00am

Getting started with AI: Overview, policies and use-cases

One of the main barriers cited to AI adoption is not knowing where to start. To kick things off our panelists will share specific use-cases of AI within IR, discuss what makes a good ‘AI user manual’ for IR teams, and provide practical advice on how to build an AI-powered IR strategy.

- Get the basics right: Defining AI in the IR context

- Discover the key applications of AI currently in use by IR teams

- Understand the key factors that make an effective company-wide AI policy, and what makes an AI for IR policy different

- Looking ahead: Discuss where AI could add the most value to IR as technologies evolve

Moderator: Laurie Havelock, editor-at-large, IR Magazine

Erik Carlson, COO & CFO, Notified

Nick Stone, head of investor relations, GSK

09:45am

Closing the AI skills gap: Ensuring your IR team is AI-ready

In this panel we’ll analyze how AI is influencing the skills and responsibilities of IR, share specific tactics to make the most of AI tools, and discuss what you can do to ensure you and your team are informed and up-to-date on how to integrate AI into existing workflows.

- Hear an overview of the main AI skills gaps and common misunderstandings for IROs

- Develop strategies and solutions to improve AI literacy & upskill yourself and your team

- Understand evolving IR skills needs in an AI-driven world

- Learn how to seamlessly integrate AI tools into existing IR workflows and processes

- Make the most of AI tools: Responsible use, prompt engineering and the role of a trusted ‘AI whisperer’

Moderator: Noemi Distefano, reporter, IR Magazine

Ross Hawley, head of investor relations, Redde Northgate

David Irish, investor relations & ESG senior manager, Vodafone

Irina Logutenkova, head of investor relations, Getech

10:30am

Networking break

11:00am

AI and shareholder engagement: Leveraging AI to improve communications

In this panel we’ll be focussing on the specific ways AI can support your shareholder communication strategy, the value (and risks) of using different AI tools to generate IR content, and explore how to responsibly use AI to ensure more impactful shareholder interactions.

- First steps: Identify low-risk applications of AI to drive efficiency in shareholder communications

- Discover use-cases of AI in shareholder communications: Social media posts, drafting releases, and other applications

- Discuss the limitations, data privacy and security risks around using AI to generate materials

- The future of shareholder engagement: How to use AI to craft more engaging content

Moderator: Laurence Taylor, senior conference producer, IR Magazine

Greg Secord, vice president, investor relations, OpenText

11:30am

AI and targeting: Identifying and approaching compatible investors

Alongside streamlining your communications with existing shareholders, AI offers enormous potential for IR teams looking to access new investors and grow their shareholder base. Here our speakers will talk through how AI can support your search for compatible investors, facilitate with outreach and ensure your messaging is accurate and tailored to its audience. We will also discuss the specific applications and pitfalls of using AI to target retail investors.

- Learn which AI tools IR teams are using to locate compatible investors

- Discover how best to use AI to analyze market trends and gain insight into investor behaviour

- Address the accuracy, transparency and confidentiality concerns associated with AI targeting

- Discuss how AI can fine-tune your outreach to a range of investors

Moderator: Tim Human, senior reporter, IR Magazine

Christian Bacherl, founder, ACCNITE

Gabriel Gonzalez-Gutierrez, investor Relations & ESG manager, Rolls-Royce

Jennifer Ramsey, senior investor relations manager, Imperial Brands

12:20pm

AI for IR lightning pitch

Hear directly from a variety of service providers on how their tools and technologies can benefit your IR function. See innovative product demonstrations, take part in interactive polls and Q&As, and get up to speed on the rapidly evolving AI for IR vendor landscape.

12:30pm

Lunch

13:30pm

AI and the buyside: Adapting your messaging to AI-driven capital markets

The buy-side has been using AI for years to inform their investment decisions, from algorithmic trading to sentiment & market analysis. In this panel we’ll examine how the adoption of new AI tools and technologies is reshaping the investment landscape, and what this means for IR teams looking to ensure their company story is communicated effectively.

- Learn how investors are using AI tools and using AI to inform their investment decisions

- Discuss the implications of an AI-driven capital markets ecosystem on investor relations

- Get ahead of the trend and ensure your investor communications are AI-friendly

Moderator: Laurie Havelock, editor-at-large, IR Magazine

Harry Jack, head of pan European equity research, Schroders

Stefanie Mollin, global equities portfolio manager, GIB Asset Management

14:15pm

Beat the bot: Using AI to anticipate analyst questions

In this interactive session, attendees will work together to analyze an earnings call summary and anticipate questions from analysts. Afterwards, we’ll compare results with ChatGPT to determine the value AI can bring in help IR teams prepare for their next Q&A.

You can read the earnings call summary here

15:00pm

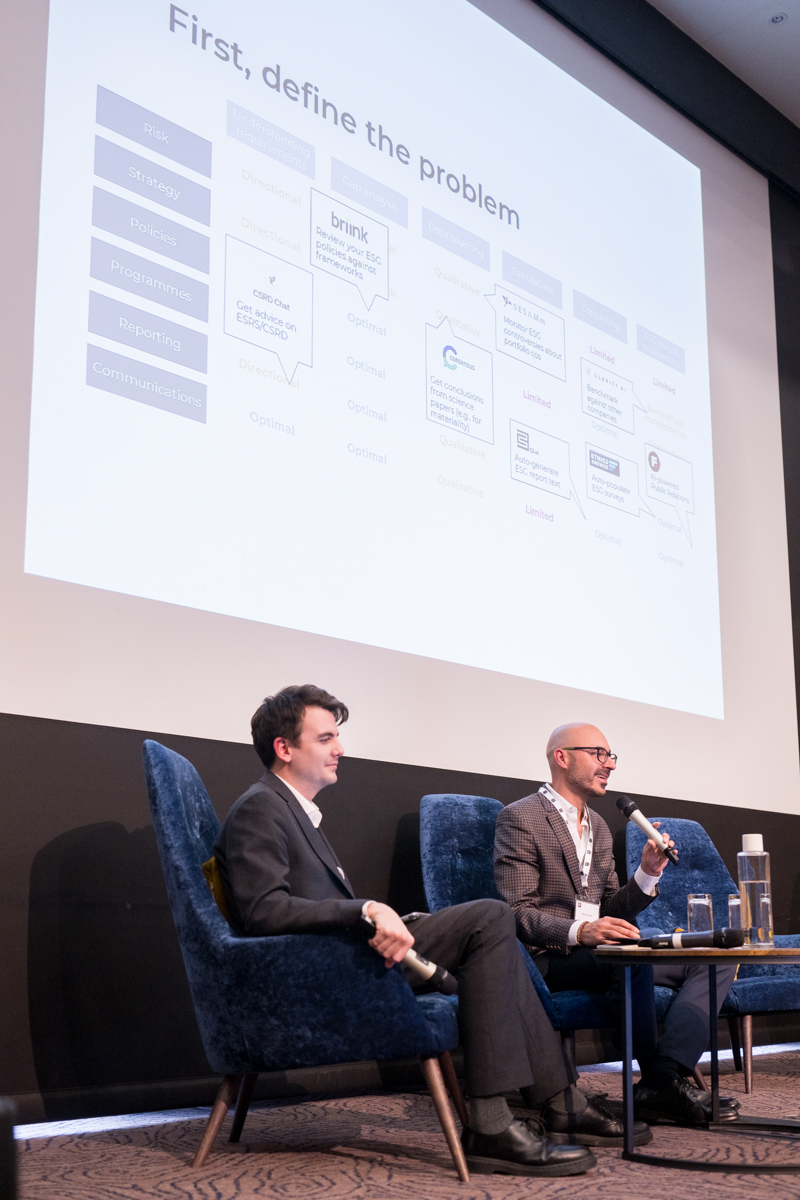

Building an AI powered ESG toolbox

This year, large companies already subject to the NFRD must comply with the CSRD, significantly increasing the scope and depth of sustainability reporting. In this panel, we’ll discuss how AI can support IR teams in their sustainability reporting journey, adapt to new disclosure requirements and deliver effective ESG communications to all stakeholders.

- Understand the role AI can play in helping to understand and comply with the CSRD

- Automate emissions gathering, sentiment analysis and benchmarking processes

- Leverage AI for sustainability reports and effective year-round ESG communications

Moderator: Laurence Taylor, senior conference producer, IR Magazine

Alex Annaev, independent expert

15:30pm

Champagne roundtables: Learn from your peers in interactive group discussions

In this interactive session, attendees will synthesize learnings into an actionable checklist to hit the ground running on deploying AI. Through group collaboration and exercises, IROs will blueprint an AI implementation roadmap that’s tailored to their IR program, including:

- Measuring success: Metrics and KPIs

- Balancing AI with human expertise

- Staying compliant with evolving AI regulations

- Managing conflicting stakeholder pressures around AI

16:15pm

Closing remarks and networking drinks

Event speakers: 2024

To inquire about speaking opportunities, contact [email protected] or +44 7804 740 172

Who attends our events

Our attendees are leading IR practitioners with an established track record and strategic IR role within their company.

Below is a sample list of our past attendees:

| JOB TITLE | COMPANY |

|---|---|

| Associate | Carlyle |

| CFO | Hexagon Composites ASA |

| Communications manager | Paragon Bank |

| Corporate development director | Pollen Street Capital |

| Deputy, head of IR | Halma |

| Director, communications | Oxford Nanopore Technologies |

| Director, IR | Fevertree Drinks |

| Director, IR | GSK |

| Director, IR | YouGov |

| ESG IR manager | ArcelorMittal |

| Financial communication manager | Airbus |

| Group head of IR | BAT |

| Head of IR | Afentra |

| Head of IR | Close Brothers Group |

| Head of IR | Subsea7 |

| Head of IR, M&A, ventures | Aperam |

| Head, investor desk | British International Investment |

| JOB TITLE | COMPANY |

|---|---|

| Head, sustainability | B2 Impact |

| Investor planning assistant | Unilever |

| IR analyst | Deutsche Rohstoff |

| IR analyst | Scancom (MTN) |

| IR and strategy | Workspace |

| IR lead | Foresight Solar |

| IR manager | Bekaert |

| IR Manager | Severn Trent |

| IR officer | Rezil |

| IR operations director | GSK |

| IR, senior manager | Schneider Electric |

| Manager, IR | Sanoma Corporation |

| Senior IR manager | BAT |

| Senior IR manager | BP |

| Senior IR manager | Foresight Group |

| Senior M&A and IR analyst | Solid State |

| VP, IR | BP |

Thinking of becoming an event partner?

Our events provide a unique opportunity to get in front of some of the most influential people in the IR community. As a partner, you will gain an extensive amount of exposure through a wide range of print and digital marketing materials, both pre and post event, as well as on the day itself. Additionally, you can use the event to align yourself with IR excellence and network with key decision makers from across the region – the ones pushing the profession forward through innovation.

What our attendees say

Register your interest

Gallery

Contact us

Upcoming events

-

Webinar – How to use data to drive IR strategy

In partnership with WHEN 8.00 am PT / 11.00 am ET / 3.00 pm GMT / 4.00 pm CET DURATION 45 minutes About the event In a capital markets environment increasingly dominated by data, IROs often overlook valuable sources of intelligence within their IR programs. Every essential tool – earnings…

-

-