The sell side talks IR – part three: when and how analysts want to be engaged

There is no denying the ways in which Covid-19 and the rapid shift to virtual changed investor relations – most notably engagement. Driving home just how dramatic that change has been, one of our anonymous analyst interviewees – anonymous in…

Featured deep dives

-

The sell side talks IR – part three: when and how analysts want to be engaged

There is no denying the ways in which Covid-19 and the rapid shift to virtual changed investor relations – most notably engagement. Driving home just how dramatic that change has been, one of our anonymous analyst interviewees – anonymous in order to encourage openness – says this: ‘Before 2020, I think I’d done probably two video calls in 20 years. This call is the third one of the day. So that’s changed dramatically.’ In the third part of our series on the sell-side-IR-relationship, we look at how IR teams interact with their analysts, how often analysts want to hear from…

-

‘I felt a mix of respect and fear’ going into IR, says Infineon’s multiple award-winning IR lead

German semiconductor firm Infineon Technologies has had a busy year. To start with, as revealed in the latest instalment of The CFO column, Dr Sven Schneider, the firm’s finance chief, told IR Impact about the 30 conferences and 20 roadshows the company has held this year. It has also been a year of huge success for the IR team, which took home some of the most prestigious IR Impact trophies at the Europe Awards in June, winning the best overall investor relations (large cap) category as well as the gong for best in sector, technology. The same night also saw…

-

‘Sometimes I have to play some Witcher or Cyberpunk during my work day’: CD Projekt’s Karolina Gnas on heading IR at a video game developer

Enjoy unlimited access to this, all deep dives and more – for free! Log in or create your free My IR – Essentials account to: Get unlimited access to 50+ IR deep dives and best practice reports Benchmark your IR program instantly with our new tool Explore 100+ news analyses plus our exclusive CFO interviews […]

-

Why listed companies should engage with hedge funds

I have been working as an IR professional for almost 15 years. To my continued surprise, I still meet peers who remain negative around hedge funds. In fact, they actively seek to minimize interaction. And if they do allow such meetings, they squeeze hedge fund managers into large group meetings, normally led by IR rather than management. To me, this approach is counterproductive. The role of the IR department is to safeguard a fair valuation of the share by communicating correctly to all relevant corners of the financial markets. I strongly believe that open doors and strong relationships improve liquidity…

-

‘The word ‘Texas’ means friend, and all are welcome!’ Barrow Hanley on its long-term value focus

Patricia Barron and Mark Giambrone talk about Texas, when IR-only meetings work and how often the investment management firm likes to meet before it buys in As companies eye Texas – and Dallas in particular – as a roadshow destination, the Lone Star State has been pushing forward its business-friendly appeal with the new Texas Stock Exchange poised to begin trading next year, listings already in place on NYSE Texas and new legislation. Patricia Barron, executive director, chief operating officer and head of risk at Barrow Hanley, and Mark Giambrone, the investment management firm’s executive director, head of US equities…

-

The sell side talks IR – part two: those crucial coverage numbers

In a series of anonymous conversations – with identifies protected in order to get frank responses – IR Impact talked to sell-side analysts about their relationships with IR professionals. In part one, we looked at the value of research – from both the IR viewpoint and from the sell side, including advice from analysts on how they felt IR could improve data sharing, face time, responsiveness and more – all the elements that go into a good IR-sell-side relationship.

-

The CFO: ‘We’ve done 30 conferences and 20 roadshows this year,’ says Infineon’s Dr Sven Schneider

Semiconductors and chips might be synonymous with Taiwan. But Germany’s Infineon Technologies is not only growing its own market share in key industries but is helping to drive forward the EU’s goals on chip manufacturing – captured in the European Chips Act, which aims to double the bloc’s share of global chip production to 20 percent by 2030. Infineon also happens to excel at investor relations, taking home some of the most prestigious awards at this year’s IR Impact Awards – Europe. The firm won the gong for best overall investor relations (large cap); best investor relations officer (large cap)…

BENCHMARKING TOOL

Instantly compare your IR program with peers using real-time analytics on budgets, team size, reporting lines, analyst coverage, and investor meetings.

Featured research

-

Governance Playbook: From compliance to confidence: Proxies that win trust and votes

The proxy statement is no longer just a compliance document, but a strategic communication tool that reflects your company’s governance priorities, transparency and responsiveness to stakeholder expectations. The 2025 proxy season introduced a wave of new practice, from evolving ESG and DE&I disclosures to heightened attention on cybersecurity and AI. As investor demands grow more sophisticated, companies must respond with greater clarity, depth and strategic foresight. This playbook offers a comprehensive, actionable framework to help your organization elevate its proxy disclosures. Learn how leading companies are navigating the changing landscape and positioning their proxy statements as both regulatory assets and…

-

Playbook: How to conduct impactful scenario plans

Scenario planning allows IR teams to give investors and analysts and indication of how various events (e.g. interest rate changes, a global conflict, a change in political regime) will affect it in the future. It also takes into account how peers and competitors are communicating around these scenarios, too. In making sure you can give your shareholder community a long view on various outcomes, it means they have more confidence in you and your interactions with them. In addition, it allows IROs to have a seat at the strategic table and help their companies plan for the future. S&P’s platform…

-

Playbook: How to deliver capital market days that impress investors & analysts

This playbook contains tips and desires shared by investors and analysts – many of them on our IR Impact Award judging panels – on what they want from investor days as well as what turns them off.

-

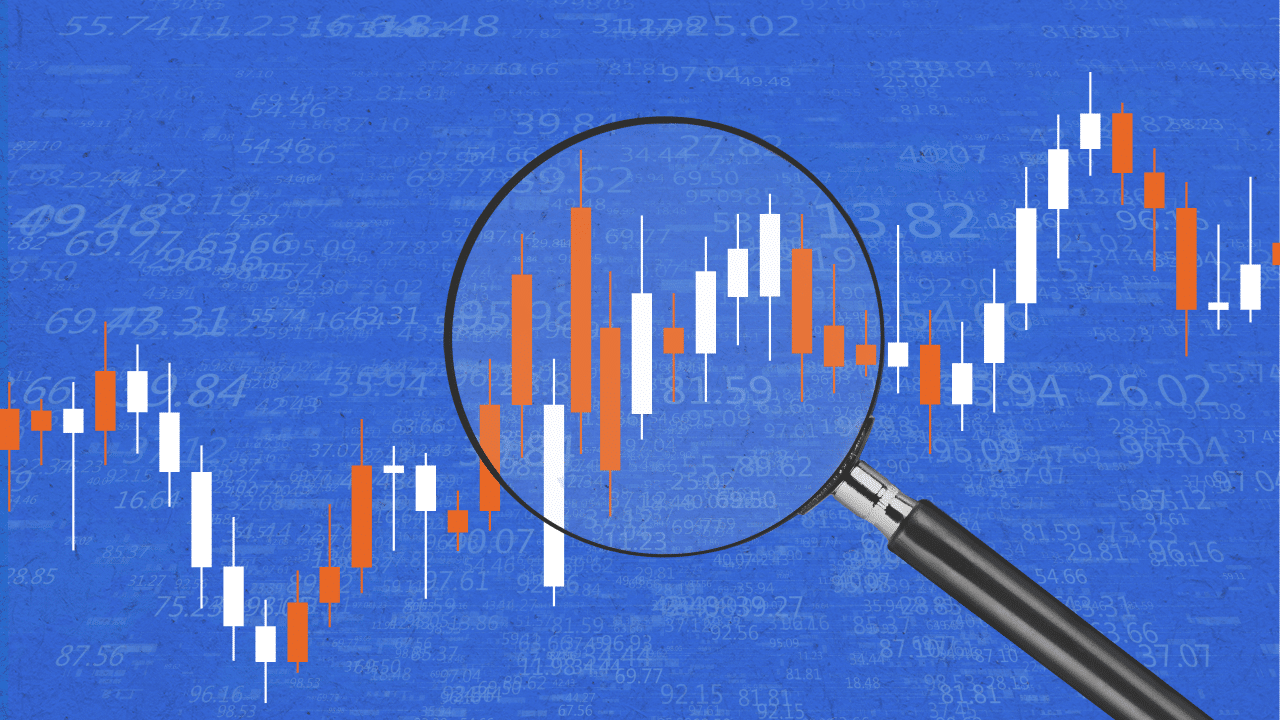

Playbook: How to leverage data to successfully navigate market expectations

A modern IR team needs a solid foundation of real-time analytics to confidently steer their organization through the turbulence of market expectations. High-quality data transforms challenges into opportunities, fostering a culture where every forecast is an informed step toward sustainable growth. This playbook, developed in partnership with Visible Alpha, now a part of S&P Global Market Intelligence, offers a comprehensive guide to mastering this critical aspect of navigating the capital markets.

Create your ‘My IR’ profile

Save articles to a personalised dashboard and share with peers

IR benchmarking tool

Instant comparison data at your fingertips. This advanced tool provides real-time analytics comparing your IR program to peers in your region, sector, and cap size. Evaluate your program’s strengths and uncover opportunities for growth with key IR metrics covering:

- IR budgets

- Team size

- Reporting lines

- Sell-side analyst coverage

- Investor meetings

Fast, intuitive and packed with tailored insights, it’s the ultimate resource for building a smarter, data-driven IR strategy.

Upcoming events

Exclusive best practice events and celebrations of IR excellence

Connect, learn and network at our forums, think tanks and award ceremonies – your go-to for the latest IR trends, regulatory updates, investor engagement strategies and valuable networking opportunities.

-

Briefing – Earnings in 2026: Keeping your story consistent under market scrutiny

In partnership with WHEN 8.00 am PT / 11.00 am ET / 4.00 pm BST / 5.00 pm CET DURATION 45 minutes About the event With investors and analysts consulting an increasing volume of data sources to inform their investment decisions – as well as using AI to enhance their…

-

Briefing – Making your 2026 investor meetings count

In partnership with WHEN 8.00 am PT / 11.00 am ET / 3.00 pm GMT / 4.00 pm CET DURATION 45 minutes About the event After a year of rapid technological advancements and significant macroeconomic change, it’s more important than ever for IR teams to maximize the impact of their…

-

Corporate Governance Awards

About the event WHEN WHERE VENUE_ADDRESS Awards by nomination Categories Awards by research Categories What our attendees say IR Rankings – LOCATION The IR Rankings – LOCATION report is the ultimate benchmarking resource for any IRO looking to improve their IR program. It provides detailed analysis and statistics on the…

SUBSCRIBE TO IR IMPACT

Unlock insights, intelligence and influence to make a real impact

IR Impact is your go-to platform for news, analysis and actionable investor relations intelligence. With cutting-edge benchmarking tools, expert-led research and in-depth reporting, we empower you to stay ahead of industry trends, make better decisions and drive meaningful impact in your IR program and the IR profession.

Choose from three flexible plans with monthly or annual options and get:

- Smarter decisions – Insights from the world’s largest buy-side, sell-side and IR survey

- Stronger engagement – Understand investor priorities and refine your strategy

- Expert knowledge – Access masterclasses and industry-leading research

- Proven intelligence – 35+ years of IR expertise to help you stay ahead

- Career advancement – Tools to elevate both the IR profession and your career

Explore

Articles

Stay informed on critical issues affecting IR teams, gain expert analysis of market trends, buy-side insights, career advice, and more.

Peer comparison

Our new tool lets you benchmark your IR program against peers in your region and sector, uncover strengths, and identify areas for growth.

Playbooks

Packed with industry trends and insights that define best-in-class practices across key, practical, and timely aspects of an IRO’s role.

Research reports

Powered by the world’s largest survey of the buy side, sell side, and IR professionals, discover data-driven insights on running a successful IR program.

3BL news

See here for news about sustainability and corporate social responsibility from organizations around the world. Sponsored by 3BL News

What’s on your mind?

We’d love to hear from you! Tell us what issues you want us to cover, questions you’d like answered or data you need. We read every submission and will reply if you leave your email (optional).